Investing in Sugar Commodity via Sugar Futures

Agricultural Commodities

Before getting into sugar and investing in sugar as a commodity through sugar futures, let's take a quick look at the agricultural sector overall and its immediate and long term future.

First of all, agricultural products and inventory are down to their lowest levels in literally decades, so that alone ensures growing demand and the inability to supply. That means the overall sector should go up, as food prices skyrocket.

We have to keep in mind that we have to look at individual foodstuffs, but overall the price of food will rise, with some food prices increasing more than others.

Another reason agricultural prices will rise, along with some metals, is the inability to get loans for new equipment, fertilizer, and a host of other things farmers may need.

These means there will be less planting and acreage put into use, and less product being brought to market. This doesn't look like it'll change any time in the near future, guaranteeing food prices will rise.

Trading Commodities and Financial Futures

Government bailouts and food inflation

The ill-advised bailouts by governments across the world of major corporation will result in growing inflation as too much money in the system always results in prices increasing and the value of currencies dropping.

That will affect the price of food, and sugar prices as well, making an impact on the agricultural commodities market.

Agricultural options and agricultural futures will be a big part of the agricultural commodity trading picture, and so the strength of currencies will play a major role in all of this, and inevitably the price of sugar.

Sugar demand sugar prices going up

Sugar Prices Going Up?

Why am I so confident sugar prices will go up specifically?

A cursory look would seem to imply that I would be wrong, as recent sugar prices are at a 28-year high. Conventional wisdom would seem to say that we should take our money and run while waiting for a market correction in sugar.

While there of course will always be ups and downs in any market, with sugar there are a number of forces working which should guarantee prices will rise for a long time.

Sugar supply and demand

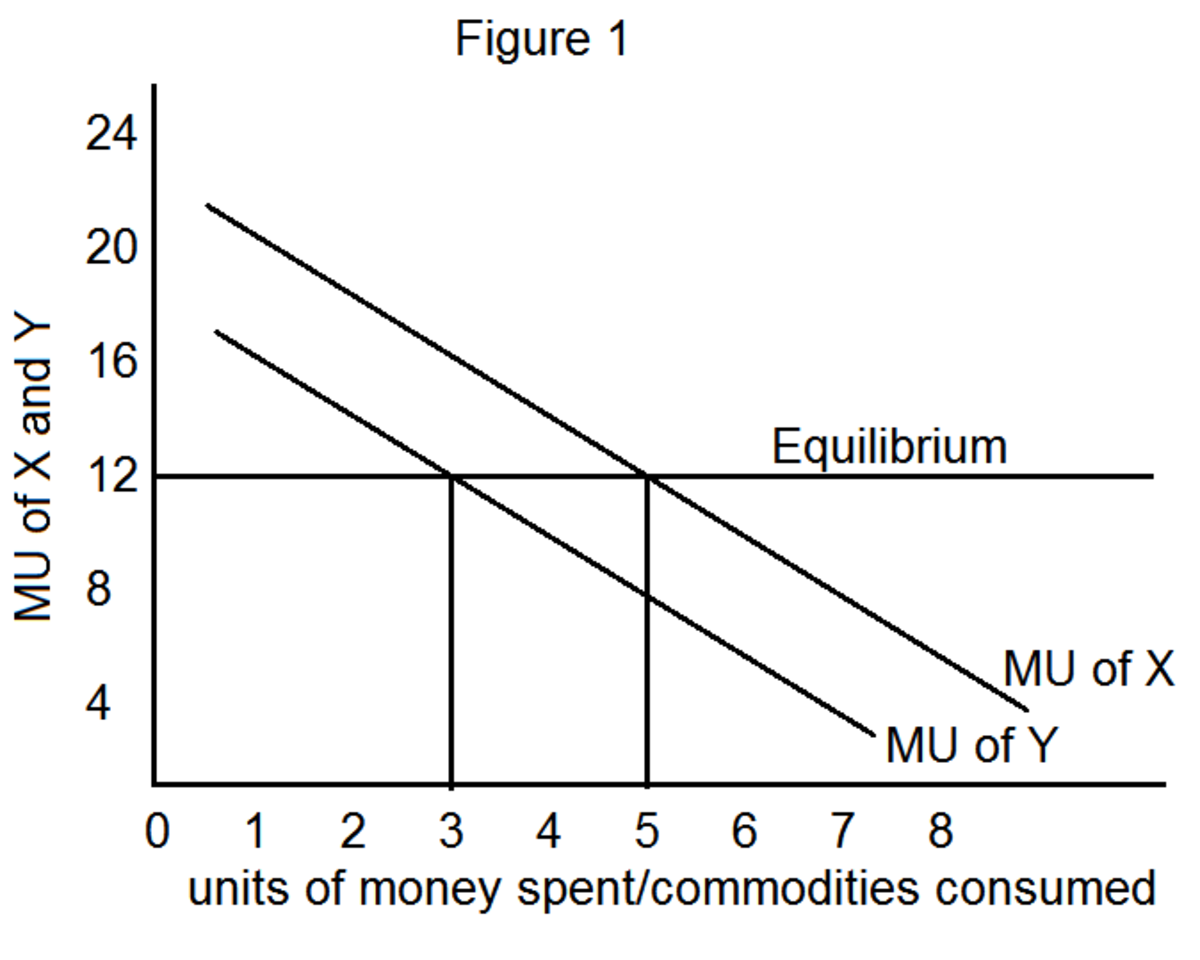

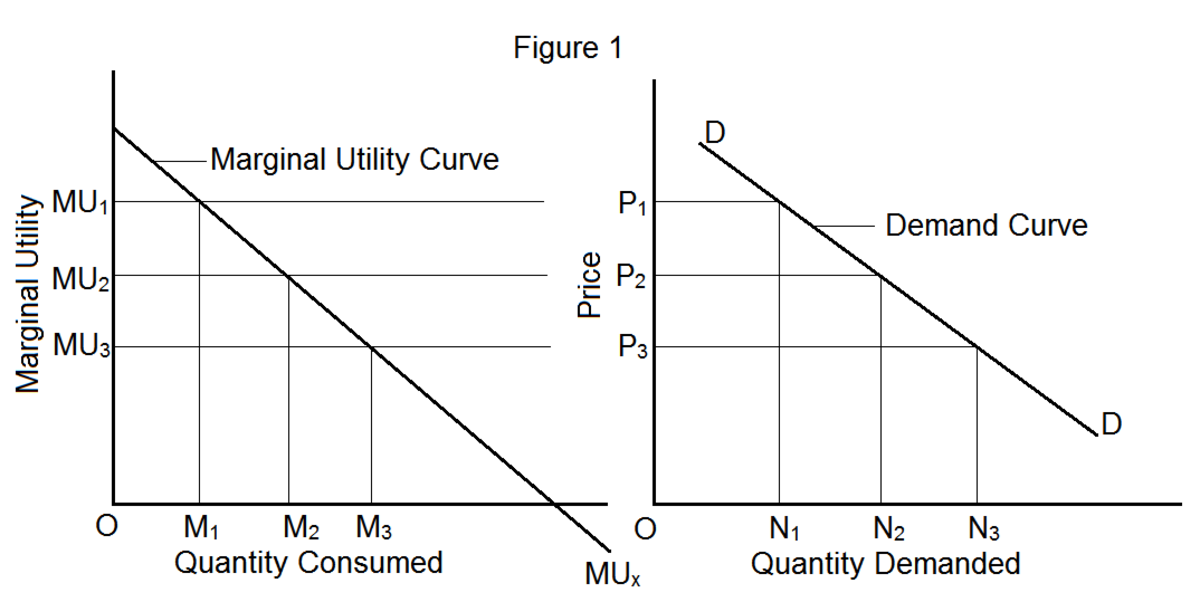

Commodity prices, like everything else, are always determined by supply and demand, and so also sugar.

Sugar demand will remain high and difficult to supply because sugar is no longer used simply for food, but now has been included in other endeavors.

So with competing demands for sugar, that will continue to push prices up as it's not able to be filled.

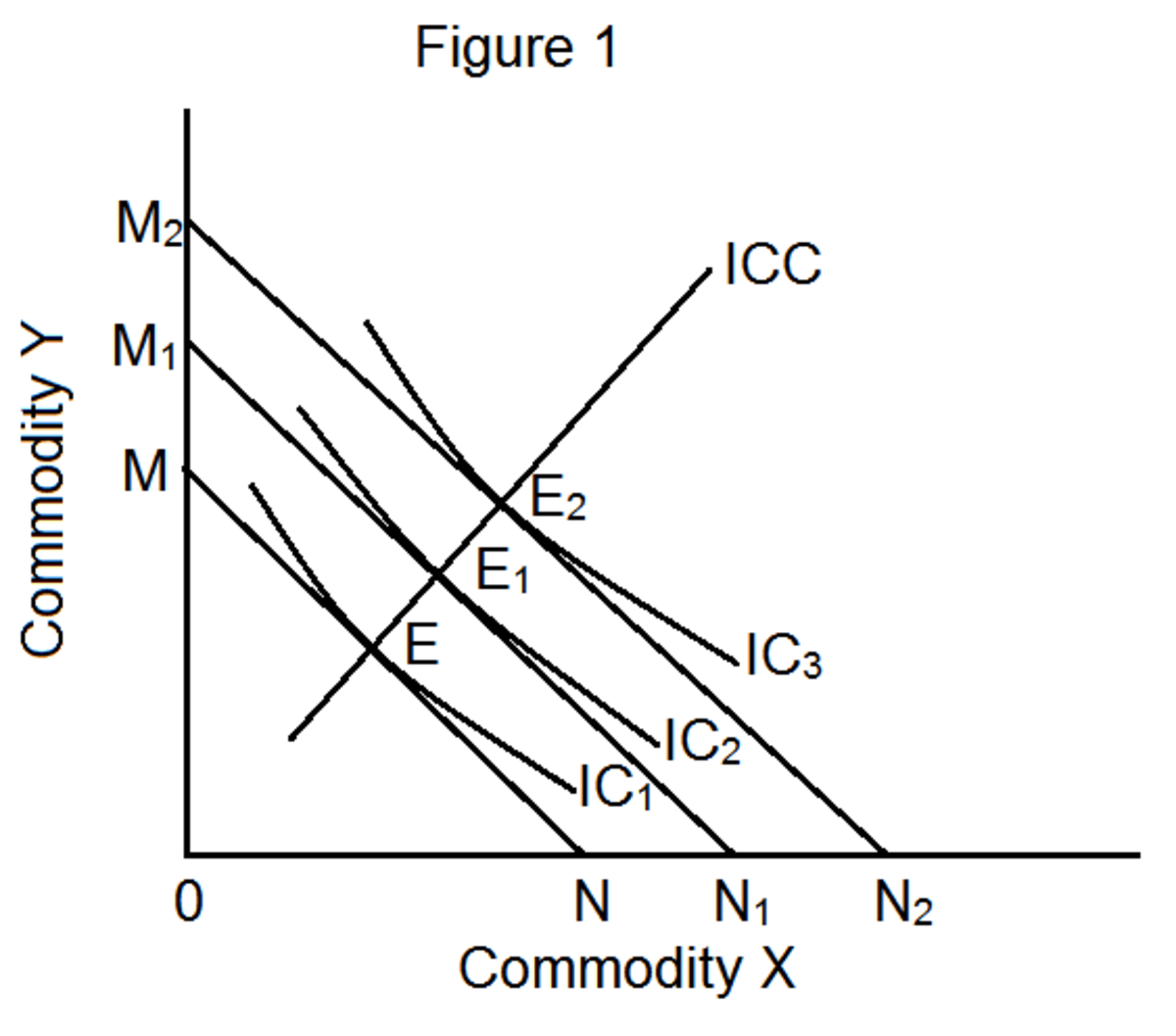

Also the growing middle classes in large countries are increasing demand, as when consumer have the money, food products including sugar rise in demand.

Other competitive factors affecting sugar prices going up

So when you include competing industries for sugar, that alone would be a significant factor relating to the last bull market in sugar, but when you add Asia and growing middle classes to the mix, there is no doubt sugar is far from its high.

This doesn't mean it'll happen overnight, but for several years or more sugar should continue to rise in price.

Investing in Sugar Futures

Probably the best way to invest in sugar is through sugar futures.

That way you don't have to be concerned about whether a company is managed well and the many other factors. All you have to do is watch for the ability for the market to supply the growing demand.

How satisfactorily that is able to be done will determine whether sugar prices will go up or down.

What about the high price of sugar today?

Another reason sugar prices are going up is even though they stand at their highest levels in 28 years, that's not the entire story, as it's still down an enormous 70 percent from its all time high, giving a lot of room to move upward.

So historically speaking, sugar is still very down or depressed, and should continue on in legitimate bull market behavior.